Authors: Aaron Klein and Ember SmithFriday, February 5, 2021

ABSTRACT

As the United States prepares for a COVID-19 recovery, policymakers need to understand why some cities and communities were more vulnerable to the pandemic’s economic consequences than others. In this paper, we consider the association between a city’s core industry, its economic susceptibility to the pandemic, and the recession’s racially disparate impact across six select metropolitan areas. We find that areas with economies that rely on the movement of people—like Las Vegas with tourism—faced substantially higher unemployment at the end of 2020 than cities with core industries based on the movement of information. Further, we find the hardest-hit areas have larger Hispanic or Latino communities, reflecting the demographic composition of workers in heavily impacted industries and susceptible areas. We conclude by recommending targeted federal policy to address the regions and communities most impacted by the COVID-19 recession.

INTRODUCTION

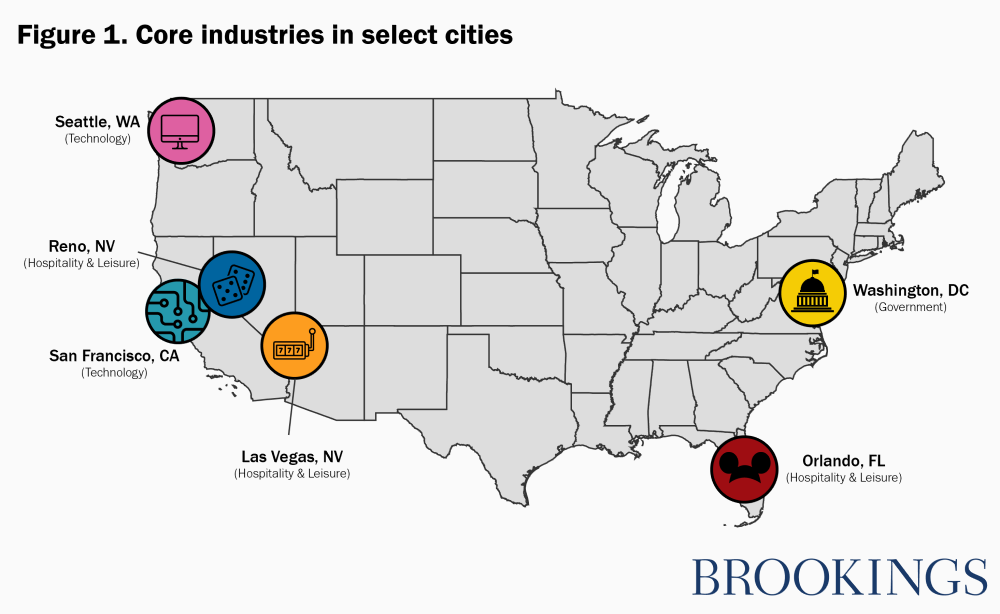

More so than any prior economic downturn, the COVID-19 recession has crushed certain industries—those that depend on the movement of people—while leaving others relatively unscathed—those that depend on the movement of information. City economies are concentrated in different industries: Las Vegas and Orlando in travel and tourism, Seattle and San Francisco in technology, and Washington D.C. in government. Thus, the COVID-19 recession’s economic geography is uniquely impacted by the pandemic’s effect on a city’s primary industry. Overlaying geography with race reveals another under-appreciated impact of this recession: an increase in the economic hardship faced by Hispanic or Latino communities.

This piece explores the economic implications of the COVID-19 recession using select metropolitan areas (often referred to by the name of the metro’s primary city), identifying problems and offering policy responses. We examine six metropolitan areas: three with heavy concentration in industries negatively impacted by COVID-19 (Las Vegas, Orlando, and Reno) and three with economies heavily concentrated in industries less negatively, or even positively, impacted by COVID-19 (Seattle, San Francisco, and Washington, D.C.). We find that the cities with industries more acutely impacted have a higher concentration of Hispanic or Latino residents.

CITY AND METRO ECONOMIES BEFORE COVID-19

Cities and metropolitan areas often specialize in select industries, creating agglomeration economies. Put simply, there is an economic benefit when firms producing similar goods are located near each other. For example, the auto industry is headquartered in Detroit, finance in New York, entertainment in Los Angeles, information technology in Seattle, and so on. The performance of core industries spills over to supporting industries and affects the entire regional economy; restaurants and retail stores do better when the core industry is booming and struggle when it is not. In this section, we discuss the primary industries in each metropolitan area of interest prior to COVID-19.

Before COVID-19, Orlando had the largest tourism industry in the nation, producing $26 billion per year, while Las Vegas came in second at over $19 billion.[1] However, Las Vegas’ total GDP is smaller than Orlando’s, so the impact of tourism is relatively larger—hospitality and leisure employed more than a quarter of Las Vegas workers in 2019.[2] There are a larger share of leisure and hospitality workers in Las Vegas than government workers in D.C. Orlando and Reno have similarly high employment concentrations in hospitality and leisure, although production as a portion of their economy is sizably smaller than in Las Vegas. Figure 2 shows that roughly one in five workers in Orlando (21%) worked directly in hospitality and leisure in 2019, as did 16% (roughly one in seven) of Reno’s workforce.[3] In these cities, many secondary industries—like the professional or business sector—are driven by their primary economic engines.

Seattle and San Francisco, on the other hand, specialize in technology, an industry that may have benefitted from COVID-19. Seattle is the well-known birthplace of Microsoft and the home of Amazon. San Francisco is the modern-day home of enormous tech conglomerates like Salesforce and Adobe and features major corporate offices for many of the Silicon Valley giants located nearby. Anchor industries employ different types of workers; employment in Seattle and San Francisco are both over two times (2.36 and 2.14 respectively) more concentrated in their largest occupational group, computer and mathematical occupations, than the national average.[4] Orlando, by contrast, has slightly less than the national rate of employment in computer and mathematical occupations, while that figure plummets in Las Vegas (50%) and Reno (54%).[5] Put another way, San Francisco and Seattle have more than four times as many employees in computers and math than Las Vegas and Reno, proportionate to the total number of workers in each metro.

Moving beyond the technology versus tourism binary, we add the nation’s capital and government hotspot, Washington, D.C., where one in five workers are employed directly by the government. The corresponding army of lawyers is a good indicator of how the primary industry of a city drives secondary workforces; D.C. has almost three times (2.76) as many legal service workers per capita as the national average. With governing also comes a demand for research (military and civilian) and, as a result, D.C. has an even greater share of employees in computer and mathematics than Seattle or San Francisco (2.46 times the national average), approaching five times as many as Las Vegas and Reno, as a proportion of each metro’s workers.[6]

For More Information: https://www.brookings.edu/research/explaining-the-economic-impact-of-covid-19-core-industries-and-the-hispanic-workforce/